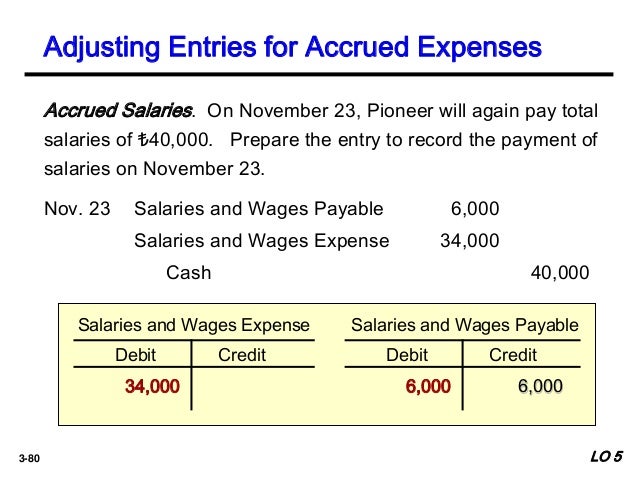

Accrued expenses are expenditures that have occurred, but have not yet been paid for. However, there are some differences between the two. With unsecured assets, terms of payment are usually aggressive (for example, within 30 days). Accounts Payable Accrued expenses and accounts payable are both types of liabilities that a company incurs during the normal course of business. Others are “unsecured,” meaning the party owed has no claim to the company’s assets. Some accrued expenses are “secured,” meaning the party owed is entitled to be paid out of the assets of the company if not otherwise paid. What is an Accrued Expense Accrued expenses, or accrued liabilities, are expenses that accumulate over time. Terms of payment are usually defined by company policy or as part of a pre-existing agreement. As far as bookkeeping is concerned, both accrued expenses and accounts payable are a current liability that is usually due within 12 months of the date of the transaction. Accrued expenses are expenses, such as taxes, wages, and utilities, that have accrued but. Even though the bill for a given month has not yet arrived, the company knows it will have to pay the usual amount. Key Takeaways Accruals are thingsusually expensesthat have been incurred but not yet paid for.

They are classified as current liabilities, meaning they have to be paid within a current 12-month period and appear on a company’s balance sheet.Īn example of an accrued expense would be a lease payment that comes due regularly each month. Growth & Transition Capital financing solutionsĪccrued expenses are those incurred for which there is no invoice or other documentation. While researching accounts payable, you may come across a similar term: accrued expenses. Common examples of accrued expenses are regular and recurrent costs such as rent, electricity, and wages. Accrued expenses are costs that are known to exist even though no invoice has yet been submitted. Kauffman Fellows Program Partial Scholarship Accounts payable are short-term expenses that must be paid because an invoice has been submitted. It appears on the balance sheet under the current liabilities. Venture Capital Catalyst Initiative (VCCI) Accrued expenses payable, also known as accrued liabilities, represent the amounts owed by a company for expenses that have been incurred during an. Accounts payable (AP) are a companys short-term debt obligations to its creditors and suppliers. Put simply, a company receives a good or service and incurs an. Industrial, Clean and Energy Technology (ICE) Venture Fund Accrued expenses are payments that a company is obligated to pay in the future for goods and services that were already delivered.

0 kommentar(er)

0 kommentar(er)